What Is A Good Bracket Score

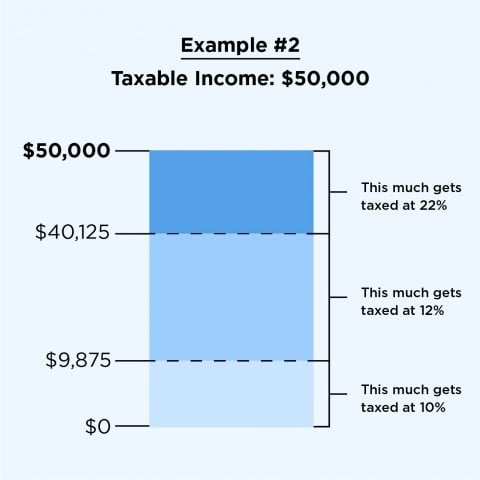

Getting good shelving brackets is essential to ensure that shelves stay in place and don’t scratch up the walls. Read full article 18 Pcs 6' Black Floating Shelf Bracket Solid Steel Blind Shelf Supports - Hidden Brackets for Floating Wood Shelves - Concealed Blind Shelf Support – Screws and Wall Plugs Included. Your tax bracket shows the rate you pay on each portion of your income for federal taxes. In the 2021 tax bracket, for instance, someone who filed taxes as a single person paid 12% on the first $9,950 of their annual taxable income. Any additional income up to $40,525 will be taxed in the next tax bracket at 12%. 40PCS L Bracket Corner Brace with 80PCS Screws, Upgrade Stainless Steel Corner Bracket, Metal Joint Right Angle Bracket Fastener for Wood Furniture Bedframe Cabinet Chair (0.79 x 0.79 inch) $4.99 $ 4. Generally, a borrower with a score higher than 740 will qualify for the top-tier rates and underwriting privileges, such as the lowest down payments and flexibility when it comes to proving your.

What is a good TransUnion® credit score? That’s a good question. But before getting to TransUnion scores specifically, it’s helpful to look at credit score ranges more generally.

The usefulness of a credit score is in the eye of the lender.

Credit scores are designed to provide a quick snapshot of a consumer’s credit health. When lenders are evaluating a credit application, they are free to use credit scores as part of that process. Or not.

What’s more, if a particular lender considers credit scores, they are free to use whichever score or combination of scores they feel will best help them make a decision. They can also assign whatever weight or significance to a score or scores they would like.

So, generally speaking, what’s a good credit score for an applicant? It’s a score which, if used by a lender, is high enough to convince that lender to lend to that applicant under favorable terms.

What about TransUnion’s credit score?

TransUnion uses the VantageScore® 3.0 model, but the above way of looking at it still applies: two different lenders may have completely different opinions on what a good-enough TransUnion score is. And since lenders may use several different sources of information to evaluate an applicant’s creditworthiness, one lender may view two separate applicants differently, even if those applicants have the exact same TransUnion score under consideration.

What does VantageScore have to say?

Though there are no magic score numbers or strict cutoffs, VantageScore does provide some guidance on the quality of certain VantageScore 3.0 score ranges in this credit score chart:

The above grades/categories are meant to give a general idea of how a score stacks up, but again, it all depends on the lender, the loan and your entire application.

While you can’t control how a lender might view your TransUnion credit score, you can control credit behaviors affecting your score. So make sure you use credit responsibly: pay your bills on time, don’t borrow more than you can afford, and watch how frequently you’re applying for credit.

See your credit trends, at a glance. Get smarter about your credit with our interactive score-trending graph.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

Understanding credit score ranges is really important.

Knowing where you fall on a credit score range can be immensely helpful because it can give you an idea of whether you’ll qualify for a new loan or credit card. Your credit scores can also help determine the interest rates you’re offered — higher rates could add up to lots of money over time.

Let’s take a deeper look at the different credit score ranges and what they can mean for you.

Understanding your credit scores

First off, you have more than one credit score, and there are a few reasons for that.

There are different scores for specific products. For example, there are special auto and home insurance credit scores. There are also different credit-scoring models, like FICO and VantageScore, which means you could have scores according to each model. Even the same model could give a different score depending on whether it uses data from your Equifax, Experian or TransUnion credit report.

Lastly, there are multiple consumer credit bureaus that provide credit reports on which scores are based. So depending on what information each bureau gets from individual lenders — and that can differ — the data used to compile your reports and build your scores could vary from bureau to bureau.

When you put it all together, that means that each individual could have multiple scores, and sometimes they don’t match. It’s difficult to pinpoint exactly how many scores you may have, but it could be hundreds.

Even though there are many different credit scores out there, it’s worth knowing the general range that your scores fall into — especially since they can determine your access to certain financial products and the terms you’ll get.

FICO and VantageScore Solutions create the most widely used consumer credit scores, and these companies update their scoring models from time to time.

VantageScore 3.0® credit score ranges

Here’s what the ranges look like for VantageScore 3.0.

| Credit score ranges | Rating |

|---|---|

300–600 | Poor |

601–660 | Fair |

661–780 | Good |

781–850 | Excellent |

FICO credit score ranges

FICO has two main types of credit scores.

- Base FICO consumer scores — These scores predict the likelihood a consumer won’t make a payment as agreed on any type of account in the future, whether it’s a mortgage, credit card or student loan.

- Industry-specific FICO scores — These credit scores are tailored for particular types of lenders, such as auto lenders or credit card issuers.

FICO® 8 and 9 consumer score ranges

| Credit score ranges | Rating |

|---|---|

300–579 | Poor |

580–669 | Fair |

670–739 | Good |

740–799 | Very good |

800–855 | Exceptional |

FICO industry-specific score ranges

| Credit score ranges | Rating |

|---|---|

250–579 | Poor |

580–669 | Fair |

670–739 | Good |

740–799 | Very good |

800–855 | Exceptional |

What credit score ranges mean for you

Lower scores indicate that someone is riskier to the lender — in other words, they’re less likely to repay debt.

Here’s how your credit score range (either FICO or VantageScore) could affect your financial options.

Poor:300 to low-600s

You might not be able to get approved for a loan or unsecured credit card at all. If a lender or issuer does approve an application, it likely won’t offer the best terms or lowest possible interest rate. If you’re looking for a credit card, you may have better luck with a secured credit card.

Fairto good: Low-600s tomid-700s

You’re more likely to get approved for financial products and may be able to shop around and compare options among different lenders. But you still might not get the best terms.

Very good and excellent/exceptional: Above mid-700s

A lender could deny anapplication for another reason, such as having a high debt-to-income ratio, butthose with top credit scores likely won’t have their applications deniedbecause of their credit scores.

People in this score range are also most likely to get offered a low interest rate and may have the most options when it comes to choosing repayment periods or other terms.

Should I just apply anyway?

It’s best not to because each application can result in a hard inquiry, which could hurt your credit. You can research your likelihood of being approved by checking Credit Karma’s Approval Odds (remember: Approval Odds are predictions, not guarantees) for a particular card or by getting prequalified for an offer (although remember that prequalification isn’t the same as being approved — you still need to apply for the card).

What your credit score means depends on the model

As you can see, different credit-scoring models may have different ranges and scoring criteria. That means the same credit score could represent something different depending on which credit model a lender uses.

A VantageScore 3.0 score of 661 could put you in the good range for example, while a 661 FICO score may be considered fair.

And lenders create or use their own standards when making credit-based decisions. In other words, what one lender might consider “very good” another could consider “good.”

Even with all thevariability, knowing where you generally fall on the credit score range canstill be important. Your range could help you determine which financialproducts you’re eligible for and the terms a lender might offer you.

What Is A Good Bracket Score Right Now

Sometimes, a few points can make a big difference

Slight day-to-day fluctuations in your credit scores are common and aren’t necessarily an indication that you’re doing something wrong. The difference between a few points might not even matter.

Say you have a credit score of 810, and you’re eligible for a lender’s best rates and terms. If your score increases to 815, it might not matter — the lender was already offering you the best deal.

But some lenders’ underwriting criteria require an applicant to meet a credit score threshold. In these cases, a rise or drop of a few points could make a big difference. So if you don’t make the cutoff, your application could automatically get rejected.

Knowing where you stand in relation to a lender’s threshold or recommended credit range can help you find the financial products you’re eligible for and give you a goal if you’re working on building your credit.

Credit score factors

There are common traits among different credit scores. For example, FICO and VantageScore use similar criteria for determining a score. Here are some of the important components in formulating your scores — though take note that these factors aren’t weighted equally.

- Payment history: This shows whether you pay your debts on time. Creditors prefer folks who pay on time, every time.

- Amount owed: This indicates how much debt you have in relation to your available credit. A good rule of thumb is to try to keep your credit use at 30% or below of your combined credit limits.

- Length of credit history: This is how long you’ve had open credit accounts. Generally, the older your accounts, the better.

- Credit mix: This makes up the different types of credit you have in your name. Creditors may want to see that you can handle various types of credit well.

- Recent applications for credit: Applying for credit can trigger a hard inquiry, which can lower your scores.

Now that you know the factors that make up your credit scores, you can focus on building or maintaining your scores so that your credit will be in good shape when you need to apply for a financial product in the future.

What Is A Bracket Challenge

Bottom line

Ultimately, lenders may settheir own credit ranges and criteria for approving an application. But if youknow where you stand on a credit score range, you can make educated guessesabout your financial profile.

You’ll be able to better predict whether an application will be approved or if you’ll qualify for low interest rates or other favorable terms. If you use this knowledge while shopping for financial products, you may be able to avoid submitting unsuccessful applications.